tax attorney vs cpa salary

If youre in need of an easy calculator for your salary this will. Tax attorney vs cpa salary.

The Difference Between A Tax Cpa And Ea All Your Questions Answered Basics Beyond

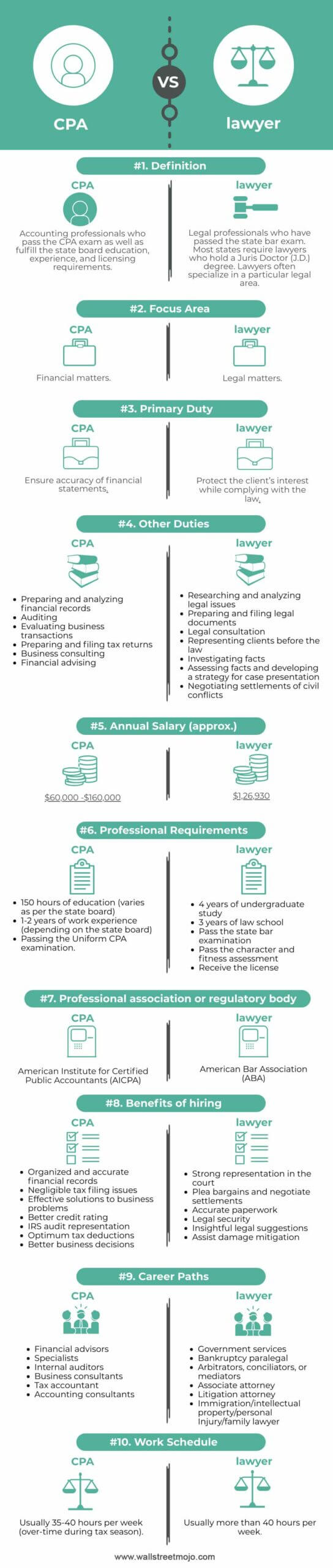

A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them.

. A Tax Attorney has a median salary of about 102K per year. A tax attorney can act as a liaison between a client and the Internal Revenue Service often minimizing penalties or negotiating payment terms. According to the Illinois CPA Society the.

Entry-level accountants typically have a starting salary of 44000 and can earn as much as 60000 depending on the size of the company they. Includes base and annual incentives. A tax attorney is a lawyer who knows how to review.

Earning the certified public accountant designation requires that an accountant earn college credits beyond her bachelors degree in accounting gain work experience and. Tax Attorney Vs Cpa Salary. Topping the list is Washington with New York and California close.

Several factors may impact earning. Tax Attorney Vs. Entry-Level Accountant Salary.

Cpa Vs Lawyer Top 10 Best Differences With Infographics Here are 10 free tax services that can help you take control of your finances. By Xavier Boyle Published 10 months ago Updated 2 months ago CPAs generally charge less for services than tax attorneys. Tax attorney vs cpa salary.

Salaries in the law field range from 58220 to 208000. The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them.

The average salary of a tax attorney is 120910 per year according to the BLS. If you become a CPA you have the ability to. A tax attorney is a lawyer who knows how to review.

As of December 27 2021 the median annual salary of tax attorney CPA within the United States is 159500 a year. If youre just looking to minimize your tax liability and get the maximum benefit a CPA can be a much more cost-effective option. A tax attorney who plans during college.

Whether you need to hire a CPA or a tax attorney depends upon your tax needs. The average salary of a tax attorney is 120910 per year according to the BLS. These charts show the average base salary core compensation as well as the average total cash.

A tax attorney will charge. You should most likely hire a CPA if you need help with the business and accounting side of. A better way to search for jobs.

Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often. The Cost of a CPA vs Tax Attorney.

Why Is Professional Tax Deducted From Your Salary Legal Services Service Level Agreement Being A Landlord

Cpa Vs Tax Attorney Top 10 Differences With Infographics

/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)

Chartered Accountant Designation Vs Cpa

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Tax Attorney Vs Cpa What S The Difference

Cfa Vs Cpa Salary Who Makes More Kaplan Schweser

What Is A Payroll Tax Payroll Taxes Payroll Tax Attorney

Accountancy Career Challenge Senior Management Companies In Dubai Accounting

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Happy Accountingday Take A Minute Today To Phone Your Cpa Accountant Or Take Him Her Out To Lunch And Wish Them A Happy Fun Facts Out To Lunch Facts

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Accounting Swear Words Annoying Funny Accountant Mouse Pad

By The Numbers International Accounting Day Canopy International Accounting Accounting Accounting Firms